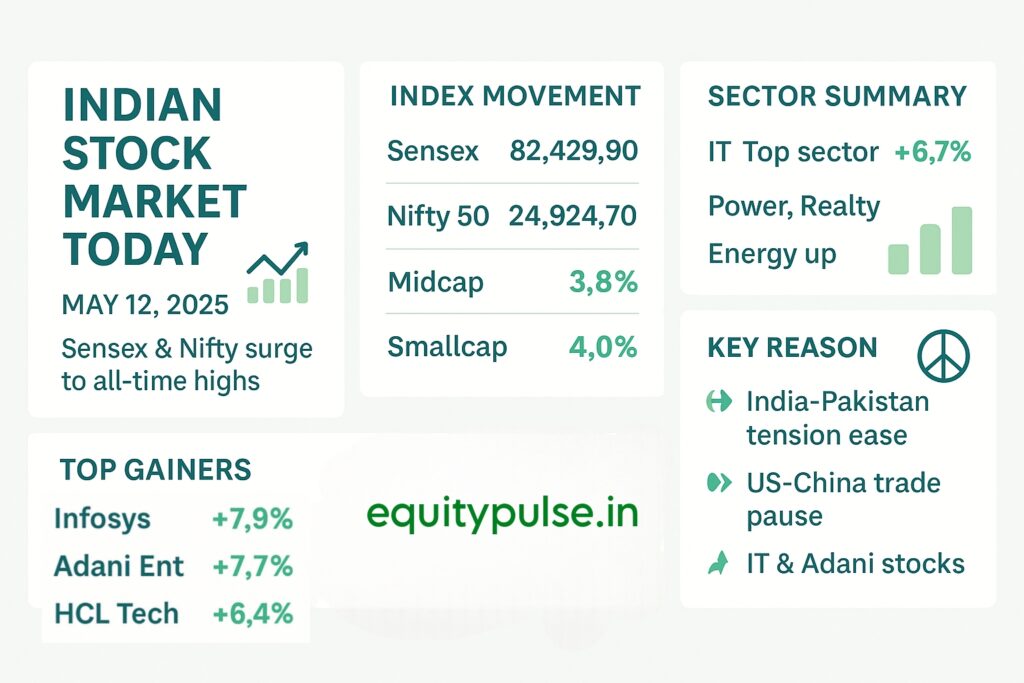

The Indian stock market saw a historic rally on May 12, 2025, with both the Sensex and Nifty 50 closing at all-time highs. Driven by a powerful combination of easing geopolitical tensions, strong global cues, and heavy institutional buying, the markets delivered their best single-day performance in four years. Investors across the board cheered the positive sentiment, triggering broad-based buying in blue-chip stocks, midcaps, and smallcaps.

🔥 Market Highlights: Nifty and Sensex Performance Today

- Sensex closed at 82,429.90, up a stunning 2,975 points or 3.74%

- Nifty 50 ended at 24,924.70, up 916.70 points or 3.82%

- Nifty Midcap 100 jumped 3.8%; Smallcap 100 soared nearly 4%

- Investor wealth increased by ₹16.15 lakh crore, according to BSE market cap data

- India VIX (volatility index) fell by over 6%, showing confidence among traders

🔍 Why Did the Indian Share Market Rally Today?

🕊️ 1. India-Pakistan Ceasefire News Boosted Sentiment

Markets rallied on reports of a mutual ceasefire agreement between India and Pakistan. This reduced geopolitical risks in the region, restoring investor confidence and triggering strong buying across sectors like defence, infrastructure, and real estate.

🌏 2. Positive Global Cues Lifted Equities

Global equity markets cheered the temporary suspension of tariffs between the US and China, which is expected to ease global trade tensions. This optimism spilled over to Indian markets, especially sectors linked to exports like IT and pharmaceuticals.

📈 3. FIIs and DIIs Turn Aggressive Buyers

Foreign Institutional Investors (FIIs) made large purchases in frontline IT and energy stocks. Domestic Institutional Investors (DIIs) followed suit, supporting the market across all timeframes.

⚙️ 4. Sector Rotation and Technical Breakouts

After a period of consolidation, several sectors witnessed technical breakouts—notably Nifty IT, realty, and energy. The Nifty’s breakout above 24,590 confirmed bullish momentum, attracting short-term and positional traders alike.

📊 Top Gainers in Today’s Market

The top-performing stocks that powered today’s rally include:

- Infosys: +7.91% – Boosted by global tech optimism and strong earnings visibility

- Adani Enterprises: +7.74% – Buying resumed after a prolonged consolidation phase

- Shriram Finance: +7.22% – Financials gained on hopes of interest rate stability

- HCL Technologies: +6.41% – Outperformed on digital growth cues

- Wipro: +5.98% – Tech recovery theme continued

- Nifty IT Index: +6.70% – Best-performing sector today

- Power, Realty, Energy Indices: Rose between 4–6%, driven by fresh long build-ups

📉 Notable Losers:

- Sun Pharma: -3.65% – Profit booking post recent gains

- IndusInd Bank: -3.63% – Downgraded by a foreign brokerage firm

📈 Technical Outlook: Nifty and Sensex Levels to Watch

- Nifty 50 decisively broke its previous resistance of 24,590, turning it into a strong support level

- Next upside target for Nifty is in the range of 25,200–25,300

- Sensex has room to move towards 83,000–83,300, given today’s price action

- Momentum indicators (RSI, MACD) are in bullish zones, but overbought signals may cause brief pullbacks

Insight: Traders should consider trailing stop-losses to lock in gains while staying in the rally. Long-term investors may use dips as entry points in large-cap IT, energy, and infra stocks.

💡Expert Insight: What This Rally Means for Investors

This rally is more than a knee-jerk reaction. It signals:

- A return of foreign capital

- Risk-on sentiment in global and domestic markets

- Rotation into growth-oriented sectors like tech and realty

- Renewed optimism ahead of upcoming macro data and policy events

From a long-term standpoint, investors should keep an eye on:

- Earnings season momentum

- Crude oil price trends

- Political developments heading into FY26

✅ Final Takeaway

The Indian stock market today showcased resilience, strength, and growing investor confidence. With the Sensex and Nifty reaching historic highs, the momentum favors a continued bullish phase in the near term. However, traders should remain alert for any global volatility or profit-booking ahead of key events.