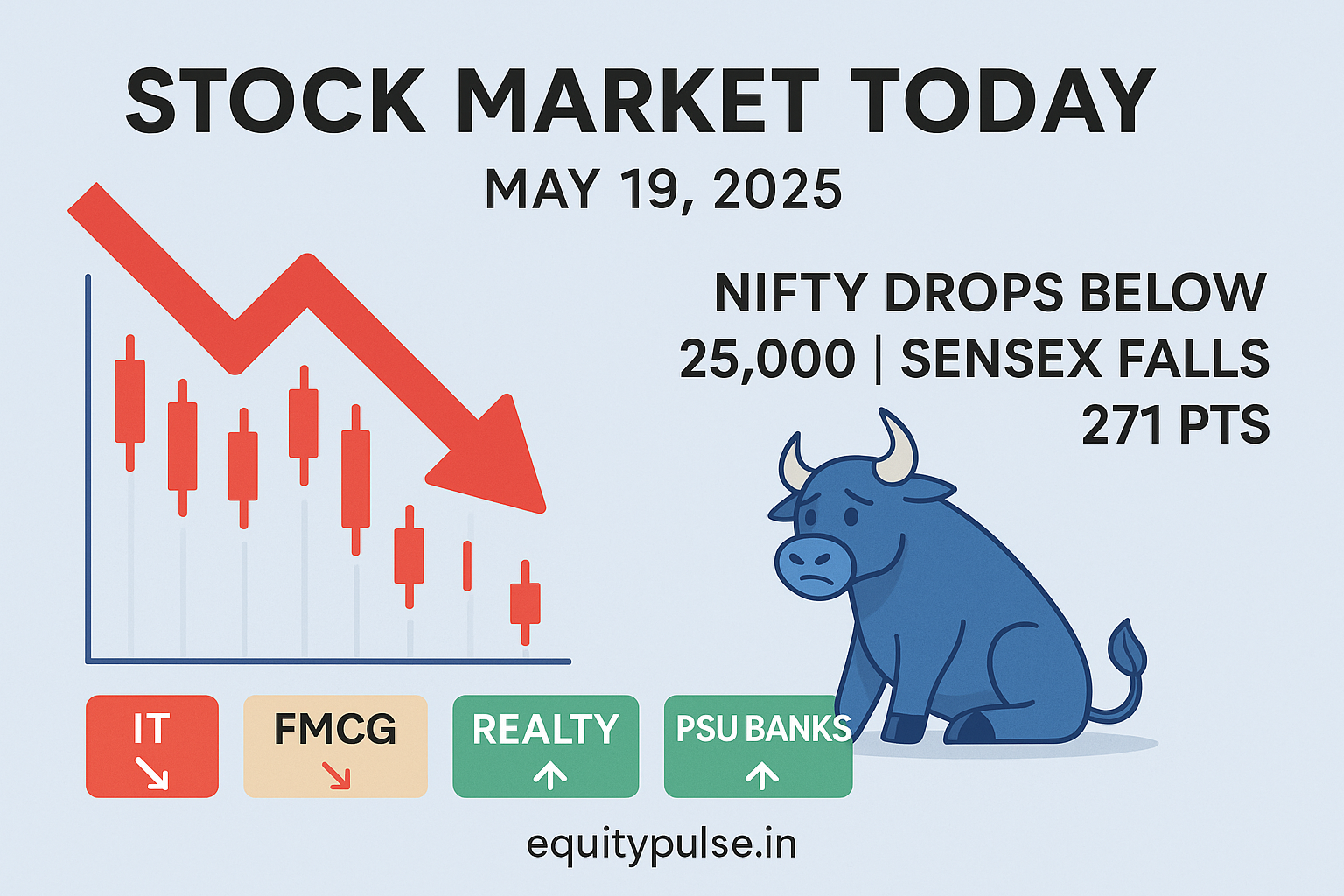

The Indian stock market began the new week on a sluggish note, with benchmark indices ending lower amid global uncertainties and sector-specific drag. Despite weakness in heavyweights like Reliance and Infosys, selective buying in PSU banks and realty stocks kept the broader market in check.

Let’s explore what moved the markets on May 19, 2025, and where investors are finding strength beneath the surface.

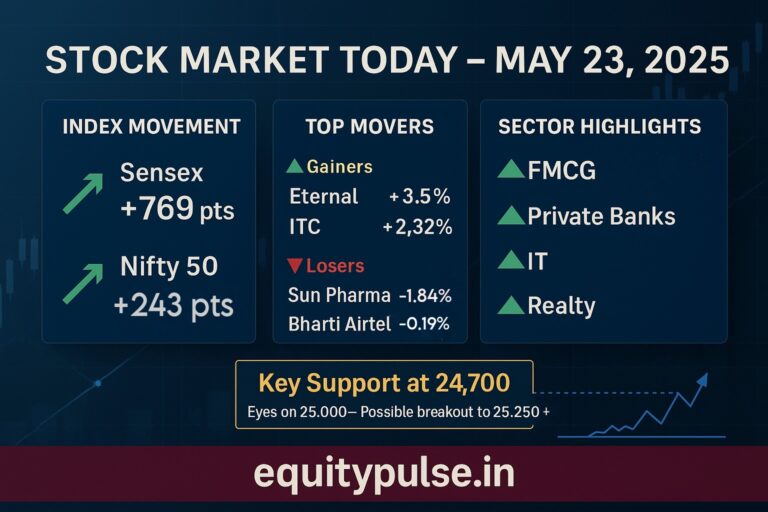

📉 Nifty & Sensex Fall as Global Jitters Creep In

- Nifty 50 closed at 24,945, down 74 points or 0.30%

- Sensex ended at 82,059, losing 271 points or 0.33%

- Nifty Bank, however, edged up 0.12%, showing relative resilience

- Midcap and Smallcap indices outperformed:

- Nifty Midcap 100: +0.08%

- Nifty Smallcap 100: +0.51%

🔍 Why Did the Market Decline Today?

1.IT Sector Takes a Hit

Indian IT stocks tumbled over 1.3%, reacting sharply to concerns about global tech spending after Moody’s outlook cut for the US economy. With a major chunk of IT revenue coming from North America, companies like Infosys, TCS, and Tech Mahindra faced renewed selling pressure.

2.Heavyweight Drag

Index majors like Reliance Industries, ICICI Bank, and Tata Consultancy Services lost ground, collectively dragging down the broader indices.

3.Profit Booking Post-Rally

After last week’s strong rally, some investors chose to lock in profits—especially in FMCG and defence-related stocks—leading to short-term selling pressure.

📊 Sectoral Performance Snapshot

- IT: ❌ Declined sharply

- FMCG: ⚠️ Soft, faced selling

- Realty: ✅ Strong gains

- PSU Banks: ✅ Continued momentum

- Auto: 🚗 Selective buying in two-wheelers

- Pharma: Flat-to-positive

Real estate stocks rallied nearly 2%, with bullish sentiment driven by improving housing demand and project launches in tier-1 cities.

PSU banks continued to shine, aided by strong quarterly results, better asset quality, and rising investor interest in undervalued public lenders.

🚀 Top Gainers: Where the Action Was

- Bajaj Auto (+4.34%) – Strong domestic demand and exports outlook

- Shriram Finance (+1.85%) – Positive Q4 momentum continues

- Power Grid Corp – Defensive play amid volatility

- Hero MotoCorp – Auto sector revival optimism

- Bajaj Finance – Mid-month inflows, retail demand tailwinds

📉 Top Losers: Where the Heat Was

- Eternal (-3.15%) – Heavy profit booking

- Grasim Industries (-2.75%) – Weaker industrial outlook

- Infosys (-1.89%) – US market exposure concerns

- Tata Consumer Products (-1.60%) – Volume pressures

- TCS (-1.19%) – Sector-wide weakness

📈 Broader Market Resilience: Midcaps & Smallcaps Hold Firm

While frontline indices showed weakness, the broader market showed strength. A positive advance-decline ratio and continued action in small and midcap names suggest bottom-up stock picking is still active.

Foreign institutional investors (FIIs) remained net buyers, signaling continued faith in India’s macroeconomic story, despite short-term volatility.

💡 What Should Investors Do?

Here’s what to take away from today’s session:

- Caution in IT & FMCG: These sectors may remain volatile, depending on global cues and earnings updates.

- Realty & PSU Banks in Favor: Real estate and public-sector lenders are drawing consistent buying interest—momentum may continue.

- Broader Market Strength: Look beyond large caps—several mid and small-cap stocks are showing technical and fundamental breakout potential.

📌 If you’re building a diversified portfolio, focus on fundamentally strong stocks in rising sectors while keeping an eye on global indicators.

🔮 Market Outlook: What’s Next?

Investors should watch the following closely:

- US Fed Meeting Minutes (due mid-week)

- India’s trade data and macro releases

- Key Q4 results from mid and small-cap companies

- Crude oil prices and rupee movement

Expect range-bound trading with stock-specific action dominating as we approach the final leg of earnings season.

🧠 Final Word from Equity Pulse

Today’s market was a reminder that even in red sessions, there’s always a pocket of opportunity. Whether it’s a strong rally in realty or resilience in midcaps, a closer look beneath the surface reveals valuable insights for smart investors.

Stay updated with equitypulse.in for daily stock market highlights, unique sectoral insights, and investment-friendly analysis you can rely on.