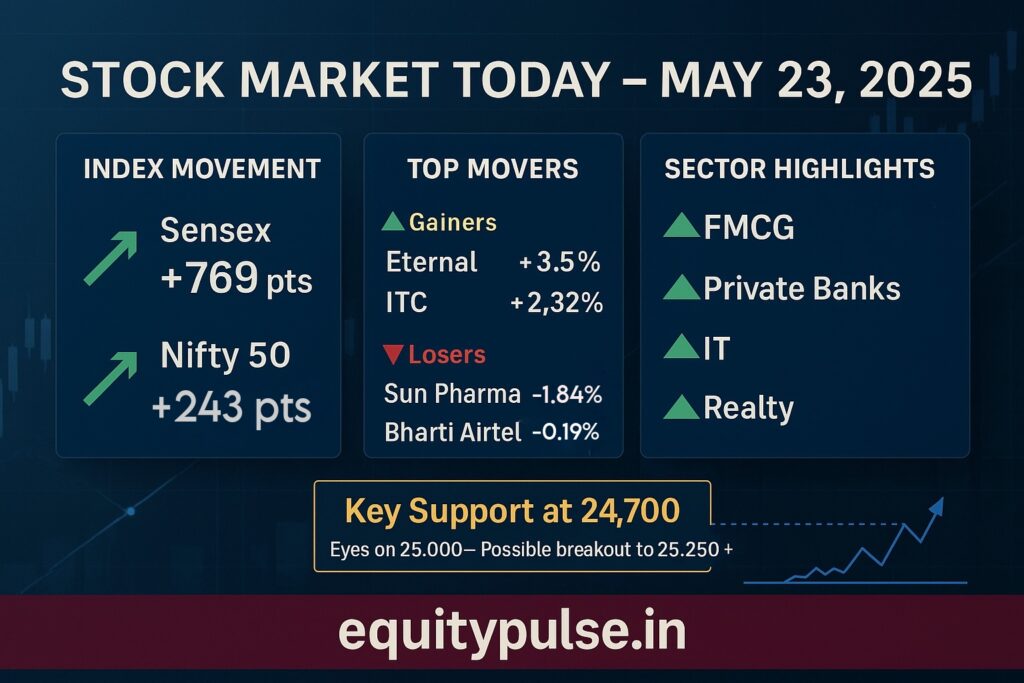

On Friday, May 23, 2025, the Indian stock market capped off a volatile week with an energetic rebound. Benchmark indices surged over 1%, signaling renewed investor confidence driven by strong gains in FMCG, banking, and IT stocks. Despite macroeconomic concerns and mixed global signals earlier in the week, Dalal Street ended on a high, led by broad-based buying across sectors.

Market Snapshot: Bulls Regain Control

- BSE Sensex soared 769.09 points or 0.95%, closing at 81,721.08

- Nifty50 jumped 243.45 points or 0.99%, finishing at 24,853.15

- Nifty Midcap100 rose 0.64%, while Nifty Smallcap100 gained 0.80%

- India VIX, the fear gauge, dipped to 17.16 (down 0.57%), indicating calming investor nerves

- Advance-decline ratio on BSE stood at 2347:1600, favoring the bulls

Sectoral Pulse: FMCG, IT & Private Banks Lead

The day saw strong rotational buying, especially in defensive and growth-driven sectors:

- FMCG rallied 1.63%, with ITC and Nestle emerging as key gainers

- Private banks and financial services rose over 1%, led by Bajaj Finserv and Axis Bank

- Information Technology (IT) saw a demand revival amid positive global sentiment

- Realty, Metals, Oil & Gas, and PSU Banks closed higher with moderate gains

- Pharma was the lone underperformer, falling 0.41%, dragged by Sun Pharma

Top Movers: Stocks in the Spotlight

Gainers on Sensex:

- Eternal (formerly Zomato): +3.5% on strong delivery growth data

- Power Grid: +2.46% amid stable transmission demand outlook

- ITC: +2.32% as investors hunted for defensive plays

- Bajaj Finserv and Nestle India also posted robust gains

Losers:

- Sun Pharma: -1.84% after Q4 earnings failed to impress

- Bharti Airtel: -0.19% amid sectoral pressure

Broader Market Highlights:

- Angel One, Delhivery, and Solar Industries attracted strong buying in the mid- and small-cap space

- Renewed retail investor activity suggests confidence beyond frontline indices

Technical View: Nifty’s Breakout Imminent?

According to technical analysts, the Nifty has established a solid support base near 24,700, which aligns with the 21-day EMA. A sustained move above 25,000 could act as a breakout trigger, pushing the index toward 25,250–25,350 in the coming sessions.

“The short-term trend looks bullish. If Nifty breaches the 25,000 mark convincingly, we may see aggressive momentum-led gains,” says Rupak De of LKP Securities.

- Immediate Support: 24,700

- Resistance Zone: 25,000–25,350

- Volatility Outlook: Cooling VIX suggests reduced downside risk in the short term

Why Did the Market Rally Today?

Several key triggers contributed to the day’s upbeat sentiment:

- Sector Rotation to Defensive Plays: Investors parked funds in FMCG, private banks, and IT, anticipating steady returns amid global uncertainties.

- Short Covering & Fresh Buying: Post-FII selling earlier in the week, technical support triggered renewed buying and short covering.

- Positive Domestic Signals: Hopes of a forthcoming India–US trade deal and sustained domestic consumption added to optimism.

- Stabilizing Global Cues: Slight easing in US bond yields and a positive US futures outlook lent global support.

Weekly Wrap: Gains Today, But a Loss for the Week

Despite Friday’s bounce, both Sensex and Nifty closed the week ~1% lower, weighed down by mid-week selling and foreign fund outflows.

FII/DII Trend:

- FIIs remained net sellers for most of the week, reacting to global headwinds

- DIIs supported the market with selective buying in consumption and banking names

What Should Investors Focus On Now?

- Watch 25,000 on Nifty: A breakout could signal the start of the next leg of the rally

- Monitor FII Activity: Sustained outflows may cap upside despite domestic strength

- Earnings Season Winds Down: Stock-specific action to dominate; Q4 results reaction to continue next week

- Stay Selective: Focus on growth at reasonable valuation in sectors like FMCG, private banking, and IT

equitypulse View: Strategy for the Week Ahead

- While today’s rally is a welcome sign of resilience, investors should remain tactically cautious. With global volatility still lurking and election-related newsflows around the corner, it’s vital to balance momentum plays with defensive bets.

We advise:

- Booking profits in overextended trades

- Holding quality large caps with earnings visibility

- Avoiding fresh exposure to highly volatile smallcaps unless risk appetite allows

In Summary: The Indian stock market ended Friday with a bang, backed by solid institutional and retail participation across sectors. A decisive move above 25,000 could be a game-changer. But until then, market participants should tread with a balanced, data-driven approach.

For real-time analysis, weekly technical outlooks, and stock-specific breakdowns, stay tuned to equitypulse.in