The Indian stock market delivered a powerful breakout rally today, with the benchmark indices hitting multi-month highs amid strong global cues and easing geopolitical concerns. Let’s explore the most critical highlights, hidden signals, and unique market dynamics that made this session stand out

— perfect for investors searching stock market today, Sensex news, Nifty live updates, or the best stocks to buy now.

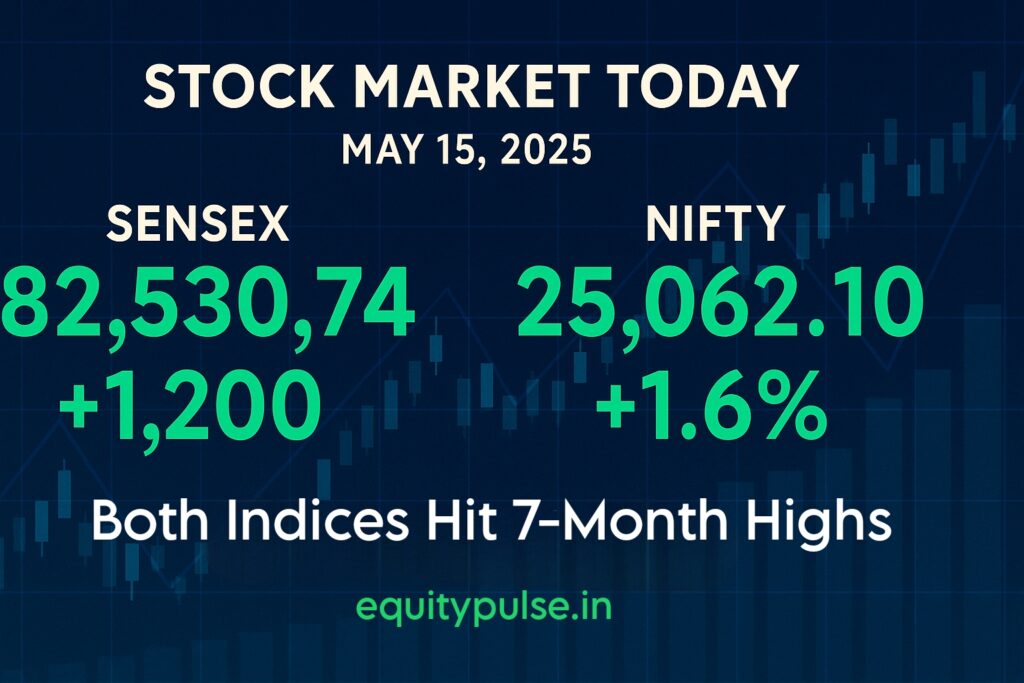

Sensex and Nifty Cross Major Milestones

The Sensex surged 1,200 points to close at 82,530.74, while the Nifty 50 broke through the psychological barrier of 25,000, ending at 25,062.10 — its highest closing since October 17, 2024. This rally wasn’t just a numbers game — it reflected a deep shift in investor confidence.

- BSE market cap rose by over ₹5 lakh crore, indicating broad-based buying across large-, mid-, and small-cap segments.

- Nifty Midcap and Smallcap indices also rose over 1.4%, showing that retail participation remained strong.

Sectoral Rally: Auto, Realty, and Private Banks Take the Lead

All NSE sectoral indices closed in the green — a rare and bullish occurrence that reflects a high-conviction rally.

- Nifty Auto and Nifty Realty surged 1.92% each, reflecting optimism around domestic consumption and infrastructure spending.

- Nifty Bank, Nifty Financial Services, and Nifty Private Bank all logged gains of 1% or more — signaling that investors are positioning for a lending cycle uptick.

- Nifty IT and Metal followed closely, supported by strong US tech cues and stable commodity prices.

Top Gainers and Market Movers Today

Several heavyweight and midcap names drove today’s market action:

- Tata Motors led Nifty gainers with a 4.16% jump, continuing its stellar run after strong global EV sales projections.

- HCL Technologies gained 3.37%, buoyed by investor expectations of improved FY26 guidance.

- Cochin Shipyard surged over 4% after reporting an 11% YoY increase in quarterly profit, triggering analyst upgrades.

- On the losing side, Muthoot Finance and Arvind declined following muted earnings.

Global & Macro Tailwinds Fuel Optimism

A key driver of today’s gains was an unexpected diplomatic breakthrough:

- Former US President Donald Trump revealed that India has agreed to lower tariffs on select US exports, softening trade tensions.

- Overnight, US markets were mixed, but mega-cap tech names like Nvidia and Alphabet posted gains — creating a favorable tone for Asian equities.

Domestically, improving GST collections, healthy earnings, and a comfortable inflation outlook are providing fertile ground for Indian equities to sustain their momentum.

Technical & Volatility Insights: Bullish Tone Confirmed

- India VIX dropped 2% to 16.89, signaling lower expected volatility and strengthening the bullish undertone.

- F&O data suggests strong resistance at 25,200 and support around 24,500, making Nifty’s breakout zone highly watchable over the next few sessions.

Expert Takeaways & Unique Market Insights

1.Fresh Inflows Likely from FPIs and DIIs

Crossing 25,000 on Nifty isn’t just symbolic — it’s a signal that could re-trigger inflows from long-term institutional investors. Expect more FPI buying if the uptrend sustains above this level for the next two sessions.

2.Sector Rotation is Real — Especially in Autos and Private Banks

The leadership shift towards cyclical sectors like autos and financials indicates investor belief in India’s domestic growth story, especially as rate cuts remain unlikely in the near term.

3.Retail Participation Remains High

The steady uptick in small-cap and midcap indices despite high valuations shows that retail investors are still actively participating — a trend not seen at this magnitude since early 2021.

4.Banking Stocks Set for Rerating?

The Nifty Bank index rally is notable. With NPAs under control and credit growth resilient, the financial sector may see a rerating, especially with PSU banks now looking fundamentally stronger.

What Should Investors Do Now?

For those looking for the best stocks to buy now, today’s data suggests focusing on:

- Auto stocks like Tata Motors and M&M

- Private banks such as HDFC Bank and Axis Bank

- Defensive IT picks like HCL Tech and Infosys

- Midcap gems showing strong earnings traction like Cochin Shipyard

Also, keep an eye on options activity near the 25,200 zone, as a breakout above that could open doors to a fresh bull leg.

Final Thoughts

May 15, 2025, could be remembered as a breakout day in the Indian markets. With the Sensex and Nifty touching new milestones, robust broad-market participation, and positive global cues, the setup remains bullish. But stay alert — especially around options expiry and global rate decisions.

For now, the market mood is decisively optimistic — and savvy investors may want to ride the momentum while managing risks.