The Indian stock market closed the week on a strongly bullish note, driven by geopolitical relief, softening inflation, upbeat global cues, and strong FII inflows.

If you’re following Indian stock market trends, Sensex and Nifty updates, or planning to invest in mid and small-cap stocks, this comprehensive recap breaks down everything you need to know.

📈 Market Overview: Bulls Take Charge as Nifty Tops 25,000

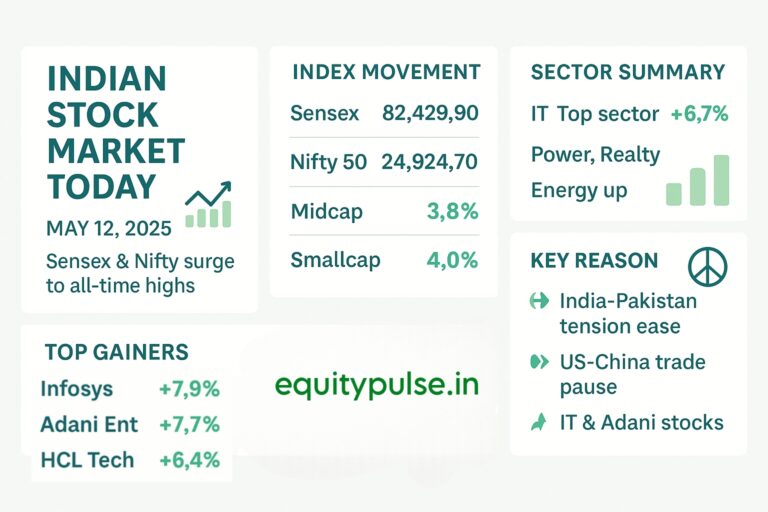

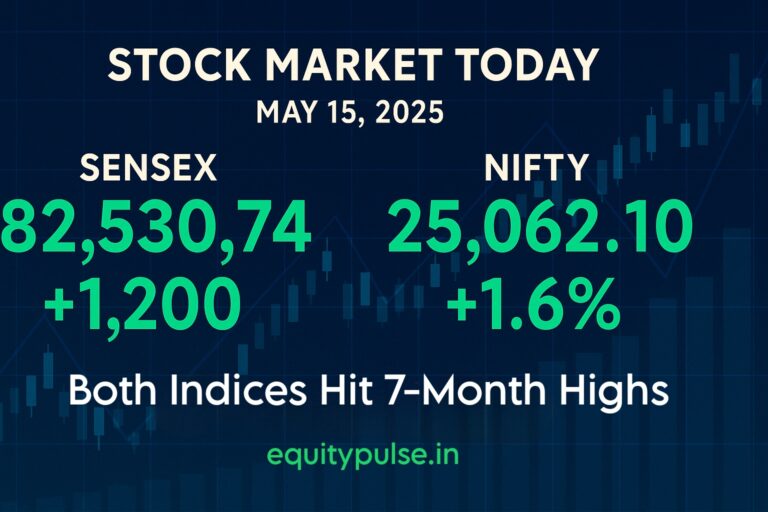

Last week, the BSE Sensex surged by 2,876 points, while the NSE Nifty50 jumped 4.2%, ending well above the 25,000 mark – a level last seen in October 2024. This surge added an eye-popping ₹26.5 lakh crore in investor wealth, as measured by total market capitalization across BSE-listed companies.

What’s more exciting is the outperformance in broader indices:

- Nifty Midcap100 rallied 7%

- Nifty Smallcap100 soared 9%

This kind of broad-based rally indicates increasing risk appetite among retail and institutional investors. It’s not just large caps driving the recovery – growth-oriented mid and small-cap stocks are attracting fresh attention.

“The market’s resilience is a reflection of improving macroeconomic factors and easing geopolitical risks” -equitypulse.in

🔍 Key Factors That Drove the Rally

🕊️ 1. Ceasefire Between India and Pakistan Calms Nerves

One of the biggest tailwinds came from the formal ceasefire agreement between India and Pakistan, which lowered border tensions and reduced geopolitical overhang. As a result, the India VIX fell by over 22%, the sharpest drop in over six months, making equities more attractive.

🌏 2. Global Risk-On Sentiment

Renewed optimism around US-China trade talks, progress in commodity supply chains, and hopes of stabilizing crude oil prices boosted emerging markets across the board. India, being a major oil importer, stands to benefit directly from easing global supply shocks.

🏦 3. Falling Inflation and RBI Policy Optimism

April’s CPI inflation dropped to 3.16%, marking the third consecutive month below the RBI’s 4% target. This is significant because:

- It increases the chance of a repo rate cut in the upcoming June RBI policy.

- Lower inflation improves corporate margins, especially in consumer goods, auto, and realty.

💸 4. FIIs Return as Net Buyers

Foreign Institutional Investors (FIIs) poured over ₹11,300 crore into equities during the week. A weakening dollar, dovish tone from global central banks, and easing volatility made Indian equities attractive again.

📊 Sectoral Snapshot: Realty and Defence Take the Lead

The rally was not sector-specific – multiple sectors saw significant action:

- 🏘️ Realty: Gained 10.7%, driven by urban housing demand, PMAY rural extension, and falling home loan rates. DLF and Godrej Properties were top picks.

- 🛡️ Defence: Stocks like HAL and Bharat Dynamics jumped amid updates from Operation Sindoor, boosting investor interest in domestic defence manufacturing.

- 🚗 Auto: Tata Motors led the pack with strong Q4 results and improving EV sentiment.

- 🏦 Banks: ICICI Bank and SBI showed strength on improving asset quality trends.

- 📦 FMCG & Consumer Durables: HUL and Asian Paints rose due to stable input costs and robust rural demand.

Laggards:

- 📱 Telecom and 💻 IT stocks faced mild corrections as investors booked profits after the recent uptrend. Bharti Airtel and HCL Tech saw limited upside but remain strong long-term bets.

💡What Should Investors Do Now?

With the Nifty holding well above key technical levels, sentiment is clearly bullish. However, this rally also brings pockets of overvaluation and volatility. Here are a few ideas for smart investors:

✅ 1. Ride the Mid and Smallcap Wave – Cautiously

The outperformance of mid and smallcaps reflects improving market breadth. But these segments can be volatile. Stick to fundamentally sound, profit-making companies with consistent earnings.

🏦 2. Stay Tuned to RBI’s June Policy

A rate cut is not guaranteed, but the commentary from the RBI will set the tone for sectors like banking, real estate, and consumption. A dovish stance could fuel the next leg of the rally.

📉 3. Buy on Dips, Don’t Chase Rallies

Markets are near resistance zones. Wait for healthy corrections or sectoral pullbacks to build positions instead of chasing short-term highs.

🌐 4. Monitor Global Risk Factors

US inflation data, bond yields, and any surprises from China’s manufacturing data can impact Indian equities. Currency movement and crude oil prices will also be crucial.

📉 Nifty & Sensex Weekly Technical Outlook – May 19 Onwards

- Nifty50 is trading above its 50-DMA, 100-DMA, and 200-DMA, signaling a strong upward bias.

- Support Zone: 24,800–24,900

- Resistance Zone: 25,200–25,600

- May 19 (Monday) will be key to confirm whether this breakout sustains or stalls.

For traders, volume confirmation, RSI divergence, and option chain data should be tracked closely.

🧠 Final Take: Bullish Bias Intact, But Mind the Triggers

The Indian stock market has entered a renewed phase of optimism, underpinned by easing macro pressures, strong institutional buying, and improving earnings visibility. However, as always, volatility and profit booking could return in pockets.

👉 At equitypulse.in, we believe in staying informed, balanced, and proactive. Whether you’re a trader or long-term investor, this week’s data shows why discipline, diversification, and data-driven investing are more important than ever.