Cochin Shipyard Ltd. (CSL), India’s leading shipbuilder and one of the top defence PSU stocks, delivered a powerful Q4 performance for FY25. From a sharp jump in profit to a fresh dividend announcement, the results have sparked excitement among retail and institutional investors alike.

Let’s break down the Q4 numbers, examine stock trends, and explore what lies ahead for this multibagger defence play.

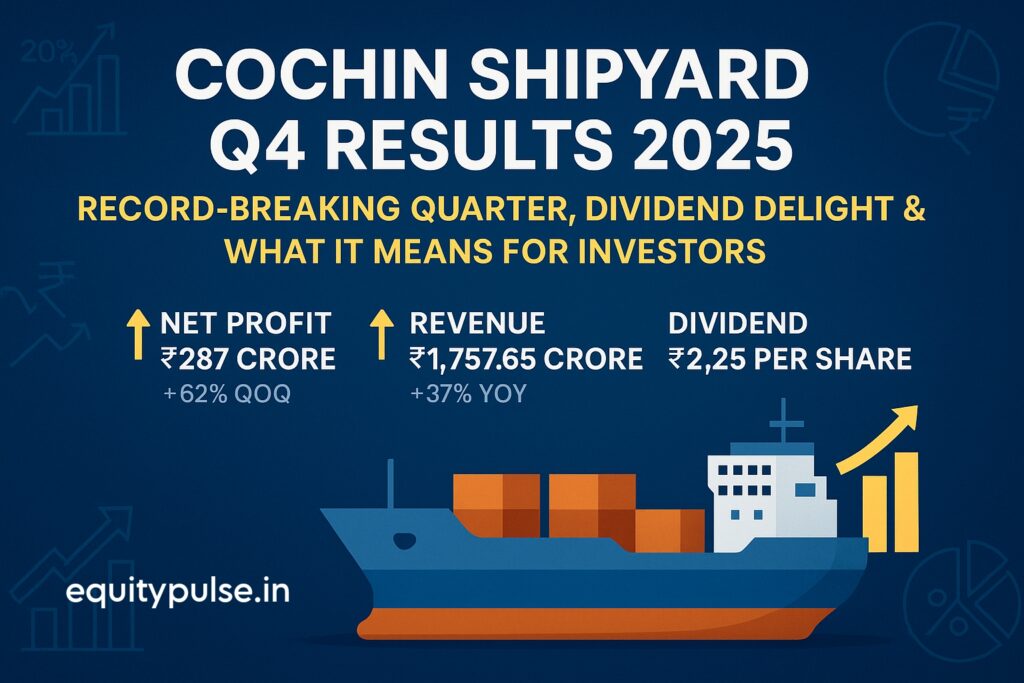

🚢 Q4FY25 Financial Highlights – Strong Finish to the Fiscal Year

- Net Profit: ₹287 crore, up 11% YoY and a stunning 62% jump QoQ.

- Revenue: ₹1,757.65 crore, marking a solid 37% YoY growth, driven by major defence projects and higher ship repair orders.

- EBITDA Margin: 20.3%, slightly down from 21.7% YoY, mainly due to higher raw material and subcontracting costs.

- Dividend: ₹2.25 per share (final), taking the total payout for FY25 to ₹6.25 per share—an attractive yield for income-focused investors.

⚙️ What’s Driving the Growth?

Cochin Shipyard’s growth story this quarter wasn’t a fluke—it’s backed by visible execution and long-term tailwinds:

1.Defence Contracts in Motion:

Large-scale naval defence projects like the Next Generation Missile Vessels (NGMV) and Anti-Submarine Warfare (ASW) corvettes contributed significantly to topline growth. These high-value orders not only boost revenues but enhance margins due to technology-driven builds.

2.Ship Repair Boom:

CSL’s growing ship repair segment—once a smaller portion of its revenue—has scaled significantly in FY25, thanks to higher capacity utilisation and improved turnaround time. This vertical has high repeat business potential.

3.Export Push:

The company has also received export orders from countries in the Indian Ocean region and Africa. This strengthens its credibility as a global player in specialised shipbuilding.

📈 Stock Performance & Investor Sentiment

- 1-Week Surge: The stock jumped over 26% in the last five sessions leading to the results.

- 3-Year Returns: A whopping 825% gain, positioning Cochin Shipyard among the best-performing PSU stocks in recent years.

- Market Cap: ₹17,500+ crore as of May 2025, firmly placing it in the midcap category.

🔍 Investor Insight:

Despite its rally, Cochin Shipyard is trading at ~15x trailing earnings, which is not overly stretched compared to private sector peers in defence and shipbuilding. The market still sees runway for re-rating, especially if larger defence orders (like IAC-II) materialize.

🔮 Risks & Cautions

While the fundamentals remain strong, no stock is without risk. Here’s what investors should watch out for:

- Order Book Execution: ₹22,500 crore order book offers 4–5 years of revenue visibility. But actual execution timelines can face delays due to design finalisations and supply chain issues.

- IAC-II Uncertainty: The fate of India’s second indigenous aircraft carrier remains a major overhang. Timely government approval will be a crucial trigger.

- Cost Inflation: Rising input costs could squeeze margins in upcoming quarters.

🧠Expert Insight: Why This Stock Still Has Steam

As a defence-focused investor, you don’t often find companies with a blend of long-term visibility, export potential, and strong domestic demand. Cochin Shipyard ticks all three boxes. In fact, the company’s positioning as a strategic asset for India’s naval ambitions adds a layer of policy-driven moat.

The consistent dividend payout also makes it a rare PSU that balances growth with shareholder rewards.

📌 Final Take – Should You Buy Cochin Shipyard?

If you’re building a portfolio focused on India’s defence manufacturing and self-reliance theme (Atmanirbhar Bharat), Cochin Shipyard deserves a spot on your radar.

- ✅ Strong quarterly performance

- ✅ Healthy dividend

- ✅ 5-year revenue visibility

- ✅ Reasonable valuation

- ⚠️ But some dependency on policy decisions like IAC-II

Long-term investors with moderate risk appetite can consider accumulating on dips. Short-term traders may want to wait for consolidation after the sharp run-up.

Cochin Shipyard Q4 Results 2025 – Verdict:

A textbook example of how PSUs can transform into agile, high-growth players when backed by strategic execution and favourable policy support. Keep watching this stock—it’s sailing ahead for a reason.

Disclaimer: This article is for informational purposes only and not investment advice. Please consult a SEBI-registered advisor before investing.