Investing in stocks can seem confusing at first — ratios, charts, numbers flying everywhere. But once you understand a few key principles, stock analysis becomes logical, even exciting. This guide will break down stock analysis in a simple, friendly way, using real-life examples, practical tools, and common-sense insights you can use immediately.

1.First, Understand What You’re Buying

When you buy a stock, you’re not buying a “price” — you’re buying a piece of a business. Imagine you’re buying a coffee shop. Before paying for it, you’d want to know:

- How much money it makes (profit)?

- How much it owns and owes (assets and debts)?

- Is it growing customers every year?

- How much are other people willing to pay for a similar coffee shop?

Analyzing a stock is exactly the same — but for listed companies.

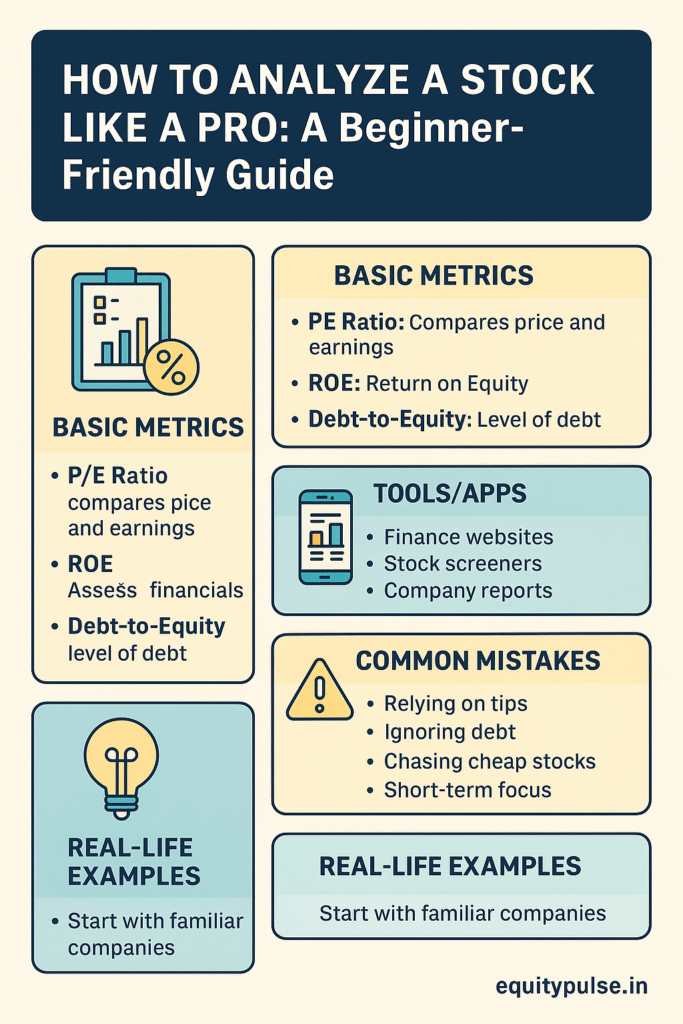

2.The Basic Metrics Every Beginner Must Know

Here are 3 absolutely essential metrics that pros check first:

a) Price-to-Earnings Ratio (P/E Ratio)

Formula:

P/E = Stock Price ÷ Earnings per Share

Meaning:

It tells you how much investors are willing to pay for ₹1 of the company’s profits.

- A lower P/E might mean the stock is undervalued.

- A higher P/E could mean expectations are very high.

Example:

Tata Consultancy Services (TCS) has a P/E of around 30. That means investors are willing to pay ₹30 for every ₹1 of TCS’s profit.

Pro Tip: Always compare a company’s P/E with its sector average, not blindly.

b) Return on Equity (ROE)

Formula:

ROE = Net Income ÷ Shareholders’ Equity

Meaning:

Shows how efficiently the company is using investors’ money to generate profits. Higher ROE = Better efficiency.

Example:

HDFC Bank’s ROE is consistently above 15% — a very healthy number for a bank.

c) Debt-to-Equity Ratio

Formula:

Debt-to-Equity = Total Debt ÷ Total Equity

Meaning:

How much debt a company has relative to what it owns.

- A lower ratio (say, below 1) is safer.

- A high ratio may be risky, especially in tough economic times.

Example:

Maruti Suzuki has almost zero debt — that’s a big positive.

3.How to Actually Analyze a Stock — Step-by-Step

Here’s a simple blueprint:

Step 1: Understand the Business

- What does the company do?

- Is it a leader in its sector?

- Does it have a competitive advantage (brand, scale, patents)?

Example: Asian Paints dominates paints with 50%+ market share — that’s a moat.

Step 2: Look at Financial Health

- Is the company growing revenue and profits steadily?

- Is it managing debt well?

- Are profit margins consistent?

Check 5–10 years of financial data. Consistency > Sudden spikes.

Step 3: Analyze Management Quality

- Who runs the company?

- Do they deliver what they promise?

- Are they ethical and shareholder-friendly?

Hint: Check past interviews, annual reports, and actions (not just words).

Step 4: Check Valuation

- Is the stock fairly priced, or overhyped?

- Compare P/E, Price-to-Book (P/B), and PEG Ratio (P/E divided by Growth Rate).

Remember: A great company bought at a wrong price = poor investment.

Step 5: Watch the Bigger Picture

- How is the overall economy doing?

- Are there sector-specific risks (like regulations, commodity price shocks)?

- Is the company future-proof (adapting to trends like digitalization, EVs, etc.)?

4.Tools You Can Use (Free & Beginner-Friendly)

- Screener.in — Fantastic for basic financial data and ratios.

- Tickertape — Easy-to-use filters, valuations, peer comparisons.

- Moneycontrol — News, results, management interviews.

- Tijori Finance — Deep dive into business models and products.

Use these to avoid “guesswork” and build clarity.

5.Common Mistakes Beginners Make (and How to Avoid Them)

- Falling for fancy stock tips — Always do your own homework.

- Ignoring debt — High profits + high debt = hidden risk.

- Chasing cheap stocks — Low price ≠ good investment.

- Not thinking long-term — Investing is not a get-rich-quick scheme.

- Overcomplicating it — Simplicity beats complexity.

Final Thoughts

Analyzing a stock like a pro doesn’t require a finance degree. It requires a clear process, curiosity, and discipline. Focus on understanding businesses, not just chasing stock prices. The greatest investors (like Warren Buffett) succeeded because they viewed stocks as ownership in companies, not gambling tokens.

“The stock market is designed to transfer money from the active to the patient.” — Warren Buffett

Master the basics, and over time, you will develop the instincts and confidence to pick strong stocks yourself — just like a pro.