Initial Public Offerings (IPOs) are often seen as exciting, one-time opportunities to enter early into a company’s growth story. But not all IPOs turn out to be winners. In fact, some end up destroying investor wealth soon after listing.

So how do you decide whether an IPO is worth applying for? What should you actually look for beyond the buzz and social media hype?

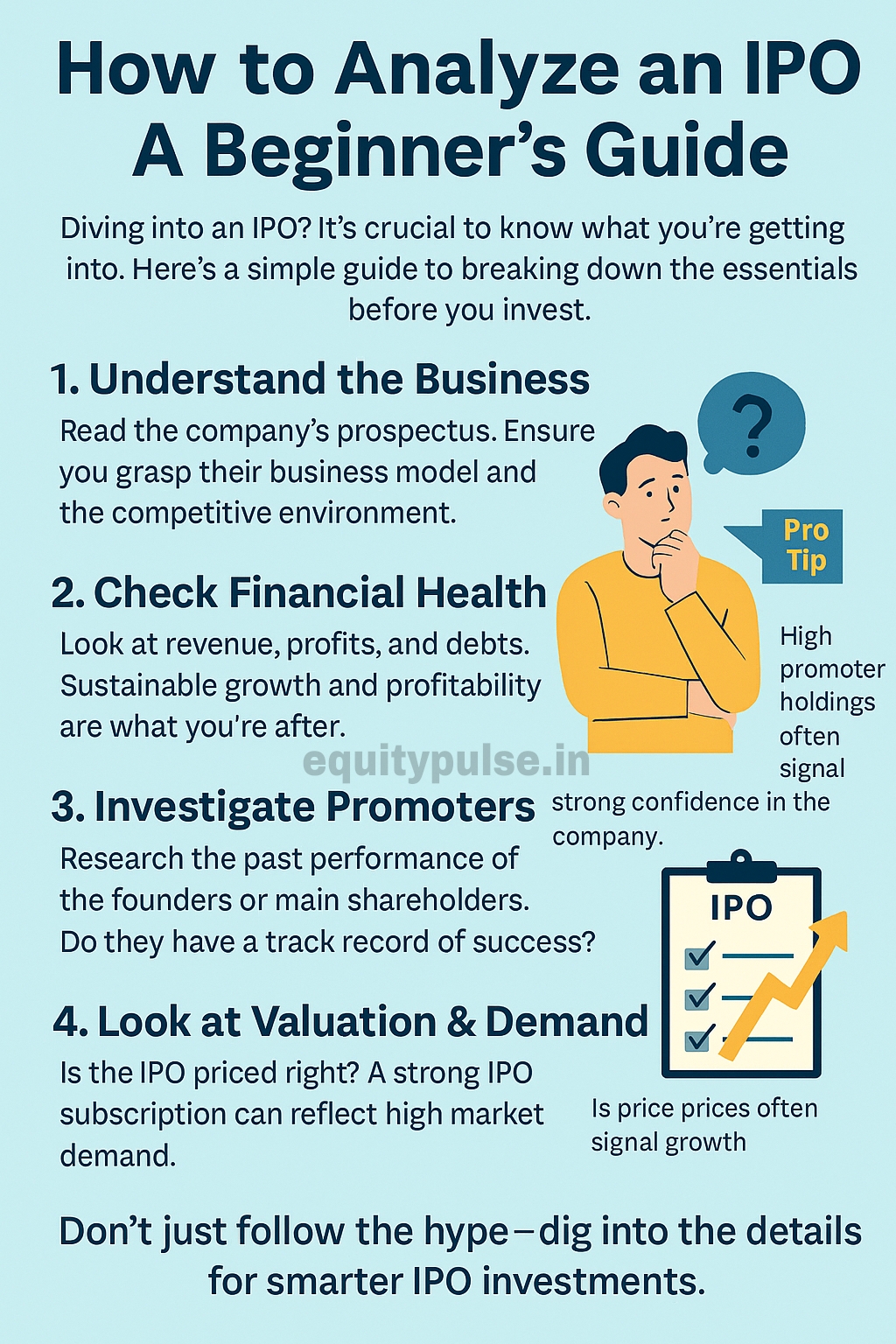

In this article, we’ll break down a practical, beginner-friendly approach to analyzing IPOs, highlight some common investor mistakes, and share actionable tips—with real examples—that can help you make smarter IPO decisions.

1.Understand the Real Reason Behind the IPO

First, ask: Why is the company going public?

- Growth funding (good sign)

- Debt repayment (neutral to positive)

- Promoter partial exit (needs caution)

Example:

When Nykaa came out with its IPO, most of the money went towards growth expansion. This gave investors confidence.

In contrast, LIC’s IPO was majorly an offer for sale by the government — no fresh money came into the company. It listed weakly.

Simple Tip:

Prefer IPOs raising funds for business growth rather than just for promoter exits.

2.Study Basic Financials (Even If You’re Not a Finance Expert)

Look at these simple points:

- Is revenue growing steadily over 3 years?

- Are profits increasing, or at least margins stable?

- Is debt low compared to equity?

- What are the Return on Equity (RoE) and Return on Capital Employed (RoCE) numbers?

Example:

Syrma SGS showed clean financial growth and healthy margins before its IPO. After listing, it rewarded investors handsomely.

Simple Tip:

If numbers are confusing, search for simple IPO reviews on websites like Chittorgarh or Screener — they highlight key financials.

3.Read the DRHP Smartly (Without Getting Overwhelmed)

You don’t need to read the entire 400-page prospectus. Focus only on:

- Objects of the Issue (how funds will be used)

- Risk factors (biggest threats to the company)

- Management background (especially if it’s a lesser-known promoter)

- Industry outlook (growth sector or declining?)

Example:

Delhivery’s DRHP openly stated risks of high competition and uncertain profitability — investors who read that weren’t surprised when the stock struggled post-listing.

Simple Tip:

Always skim through the “Risk Factors” — companies reveal a lot there.

4.Check Promoter Holding and Anchor Investors

- Higher promoter holding after the IPO shows commitment.

- Strong anchor investor interest (big mutual funds, sovereign funds) adds confidence.

Example:

Zomato had excellent anchor investor interest before its IPO (names like Tiger Global), boosting its IPO credibility even though it wasn’t profitable yet.

Simple Tip:

If the promoter reduces their stake too much after IPO, be cautious.

5.Understand Valuations (At Least Roughly)

Ask:

- Is the IPO fairly priced compared to competitors?

- Is the P/E ratio reasonable?

- Is the company asking for “future profits” price without making current profits?

Example:

Paytm’s IPO came at an extremely high valuation despite no profitability — many investors faced heavy losses after listing.

Simple Tip:

Even strong brands can disappoint if IPO pricing is greedy.

6.Look Beyond Subscription Hype

Many investors assume “more subscription = more listing gains.” While high demand helps, it’s not a guarantee.

- Focus on QIB (Qualified Institutional Buyer) subscription more than retail.

- Retail hype can be misleading — institutions study harder.

Example:

Premier Energies’ IPO in 2024 had strong QIB demand. It doubled post-listing.

But some lesser-known IPOs saw crazy retail subscription and still fell after listing.

Simple Tip:

Track QIB subscription numbers closely during IPO days.

7.Important Things About IPOs People Usually Don’t Know

- Anchor lock-in periods: Some anchor investors can exit after 30 days — sudden drops may happen.

- Grey Market Premium (GMP): Good to track, but not fully reliable. GMPs can crash before listing.

- Small lot allotments: Highly oversubscribed IPOs may allot only 1 lot to retail, even if you apply heavily.

8.Smart Tips and Tricks to Choose Good IPOs (With Real Examples)

Tip 1: Favor sectors with strong tailwinds

Look for companies in booming sectors — green energy, EVs, defense, infra.

Example:

Kaynes Technology in the EV ecosystem gave multibagger returns post-listing.

Tip 2: Analyze consistent past performance

Avoid turnaround stories unless you understand them deeply.

Example:

Syrma SGS showed 3-year stable growth — a good signal.

Tip 3: Observe anchor investor strength

If strong global funds invest, it’s a positive sign.

Example:

LIC IPO had top Indian mutual funds and sovereign funds among anchors.

Tip 4: Watch for crazy GMP jumps carefully

GMP of ₹100 today doesn’t guarantee the same GMP at listing. Stay cautious.

Tip 5: Skip the IPO if valuations seem greedy

Better to wait for listing and buy later at better prices.

Example:

Many investors bought Delhivery post-correction, after avoiding the expensive IPO price.

Conclusion

IPO investing is exciting, but needs discipline.

Use simple filters: check business strength, financial health, fair pricing, anchor backing, and sector trends.

Avoid hype, don’t fall for FOMO, and remember: sometimes skipping an IPO is also a smart decision.

If you build the habit of doing even basic research, you’ll protect your money — and sometimes, even spot the next big wealth creator early.