What Are Interest Rates?

Interest rates are basically the cost of borrowing money. When you take a loan — whether it’s for a house, a car, or even a business — the lender charges you an extra amount over what you borrow. That extra amount, expressed as a percentage, is the interest rate.

For example, if you borrow ₹1,00,000 at a 10% annual interest rate, you’ll have to pay ₹10,000 extra over a year.

At a bigger level, central banks like the RBI (Reserve Bank of India) set benchmark interest rates that influence how expensive or cheap it is for banks, businesses, and consumers to borrow money. These rates ripple through the entire economy — affecting spending, investing, and saving habits.

Why Do Central Banks Like RBI Hike Rates? How Does It Fight Inflation?

Simple answer:

Central banks like the RBI increase interest rates to slow down spending and cool off inflation.

When everything — from vegetables to electronics — starts getting expensive fast, inflation rises.

If inflation stays too high for too long, it hurts everyone, especially middle-class and poor households.

How hiking rates helps:

- Loans get costlier (home loans, car loans, business loans).

- People and companies borrow less and spend less.

- Demand slows down.

- Prices start stabilizing or even falling.

Example:

Imagine you wanted to buy a car with a loan at 7% interest.

Now, after a rate hike, your loan costs 10%.

You may delay buying the car, or not buy it at all.

If millions of people do the same, car sales drop, car prices stabilize, and inflation cools.

Real Insight:

- Rate hikes are like applying brakes to a speeding car (economy) to avoid a crash (hyperinflation).

- But if brakes are pressed too hard (too many hikes), the economy can slow down too much and cause recession.

That’s why central banks have a tough job — they need to balance growth and inflation carefully.

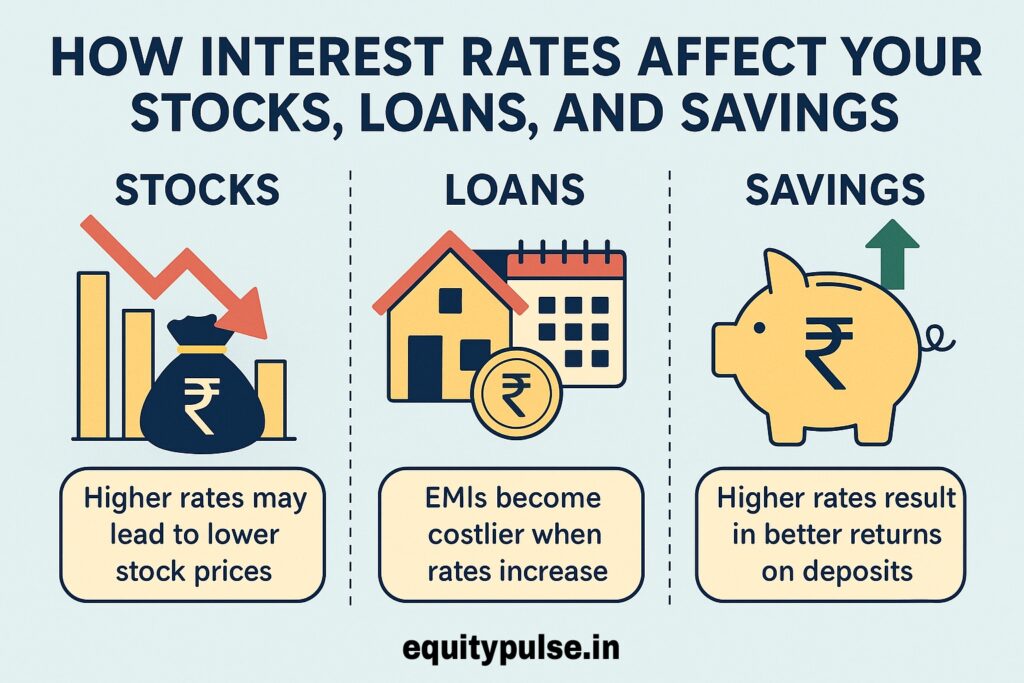

How Interest Rates Affect Your Stocks, Loans, and Savings

When you hear that the RBI has increased or decreased interest rates, it might sound like “finance news” — but it directly impacts your money.

From your stock investments to your home loan EMIs and bank deposits, interest rates play a powerful, behind-the-scenes role.

Let’s understand how, with simple examples — and why ignoring interest rates can cost you real money.

Stocks and Interest Rates – What’s the Connection?

Interest rates and stock markets are like see-saws.

- When interest rates rise, stocks often fall.

- When interest rates fall, stocks usually rise.

Why?

Because higher interest rates make borrowing money more expensive for businesses.

Imagine a company that wants to build a new factory. If loan interest goes from 8% to 12%, their cost of expansion rises.

Result?

- Profits shrink.

- Stock prices may fall.

Example:

When RBI raised repo rates in 2022 to control inflation, Nifty50 dropped nearly 15% in a few months. Tech stocks suffered the most because they depend heavily on cheap financing.

On the other hand, when rates fall:

- Borrowing becomes cheap.

- Companies invest more, hire more, earn more.

- Stock prices often rally.

Real Tip:

- Banking and financial stocks can sometimes benefit from moderate rate hikes.

- Capital-heavy sectors (real estate, infra) suffer during high rates.

Loans – Why Your EMI Depends on RBI

Ever noticed your home loan EMI suddenly increase without doing anything wrong?

Blame the interest rates.

- Most loans today are linked to the repo rate.

- When RBI hikes rates, banks pass it on to you by increasing your EMI.

Example:

If your ₹50 lakh loan was at 7% interest earlier and moves to 8%,

your EMI could go up by ₹3,000–₹5,000/month depending on tenure!

Hidden Insight:

Some banks delay increasing deposit rates but quickly raise loan rates. That’s how they make more profits during rate hikes.

What you can do:

- Switch to fixed-rate loans if you expect rising rates.

- Prepay extra if you can — even ₹5,000/month helps save lakhs.

Savings – Good News or Bad?

Higher interest rates are good for your savings.

- Bank FDs, RDs, and even savings accounts offer higher returns.

- Senior citizens especially benefit because many banks offer extra 0.5% on FDs for them.

Example:

In 2021, 1-year FDs were offering 5–5.5%.

Today, many banks are offering 7–7.5% on 1-year FDs.

Small Catch:

- Inflation eats into real returns.

- If inflation is 6% and your FD returns 7%, your real return is just 1%.

Smart Ways to Adjust Your Money Game

Investors:

- Prefer large-cap, quality companies in rising rate environments.

- Avoid overvalued, high-debt stocks (they get hit harder).

Borrowers:

- Lock in fixed rates if possible.

- Focus on reducing high-interest debt like credit cards first.

Savers:

- Ladder your FDs (divide into different maturities).

- Look at short-duration debt funds or liquid funds for slightly better returns.

Bonus: A Hidden Opportunity Most People Miss

Debt mutual funds often become attractive during rising rate periods, but only if you invest carefully.

- Short-duration debt funds, floating rate funds benefit when rates are peaking.

- Timing matters — enter when rates seem close to their highest levels.

Example:

If you had invested in a short-term debt fund during the 2018 rate hike cycle, you could have earned higher returns than normal FDs, with indexation benefits on tax.

Final Word: Don’t Fear Interest Rates — Understand Them

Interest rates move up and down based on inflation, growth, and global factors.

Instead of panicking every time RBI changes rates, adjust your strategy smartly:

- Long-term investors stay invested in quality stocks.

- Smart borrowers manage debt proactively.

- Wise savers optimize for safety and better real returns.

Remember:

“It’s not the news that matters most. It’s how you react to it.”