Swiggy, one of India’s leading food and grocery delivery platforms, has released its financial results for the fourth quarter of FY25, and the numbers tell a story of aggressive growth paired with rising challenges.

Founded in 2014 by Sriharsha Majety, Nandan Reddy, and Rahul Jaimini, Swiggy has grown from a hyperlocal food delivery startup into a multi-service giant. Operating in over 680 Indian cities, the company has expanded into quick commerce (Swiggy Instamart), concierge services (Swiggy Genie), and dine-in experiences through Swiggy Dineout. Over the years, Swiggy has completed more than 3 billion orders, a testament to its scale and reach in India’s rapidly growing digital economy.

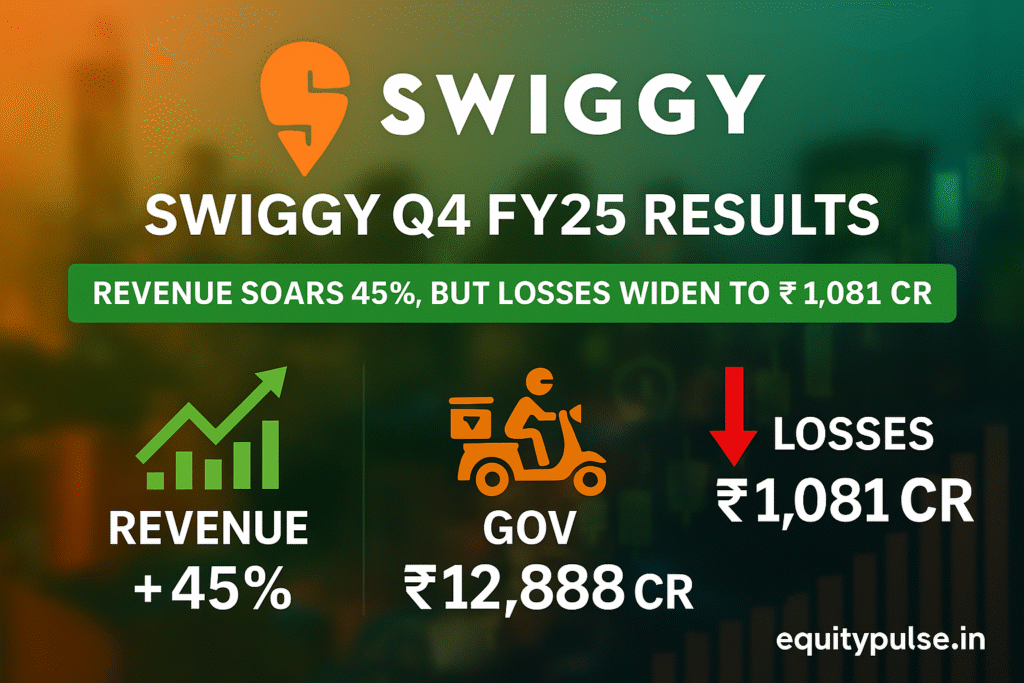

Q4 FY25 Financial Performance: Headline Numbers

Despite Swiggy’s consistent market leadership, its Q4 FY25 results indicate a classic case of growth at a cost:

- Revenue from Operations stood at ₹4,410 crore, up 45% YoY from ₹3,045.5 crore in Q4 FY24.

- Consolidated Net Loss widened to ₹1,081 crore from ₹555 crore YoY — nearly doubling due to mounting quick commerce expenses.

- Gross Order Value (GOV) grew by 40% YoY to ₹12,888 crore.

- Food Delivery GOV increased 17.6% to ₹7,347 crore.

- Instamart GOV surged an impressive 101% to ₹4,670 crore.

This robust topline growth signals rising consumer demand, but also exposes the operating pressures Swiggy faces, especially in the quick commerce segment.

Segment-Wise Performance Breakdown

🥘 Food Delivery

- Revenue grew 18% YoY to ₹1,629 crore.

- EBIT (Earnings Before Interest & Tax) rose to ₹220 crore from ₹42 crore a year ago, showing improving unit economics in its core business.

⚡ Quick Commerce (Instamart)

- Revenue jumped 58% YoY to ₹2,004 crore.

- However, EBIT loss widened significantly to ₹771 crore (vs ₹273 crore last year), reflecting intense spending on delivery network expansion, customer acquisition, and discounts.

This segment is Swiggy’s biggest bet, but also its largest cash burner, especially with tough competition from Blinkit (Zomato) and Zepto.

Strategic Developments in FY25

Swiggy’s CEO, Sriharsha Majety, described FY25 as a “year of many firsts.” The company focused heavily on building new verticals and deepening market penetration. Some key highlights:

- Profitability Achieved in “Out of Home Consumption” category.

- Strengthened operations in non-metro markets to broaden its user base.

- Technology investments continue in personalization, delivery route optimization, and customer support automation.

Swiggy is clearly playing the long game, sacrificing short-term profitability for long-term leadership in multiple consumption verticals.

Competitive Landscape

While Swiggy remains a household name, it’s navigating a tough terrain:

- Zomato’s Blinkit has seen faster monetization in quick commerce, putting pressure on Swiggy Instamart to scale profitably.

- Zepto, backed by investors like Y Combinator and Nexus Venture Partners, is capturing urban customers with 10-minute delivery promises.

The competitive intensity suggests the margin pressure will continue well into FY26.

Stock Market Insight: Swiggy on the Bourses

Swiggy, listed under ISIN: INE00H001014, is relatively new to the public markets but is already under scrutiny from investors who are weighing its growth versus profitability.

- Pre-result share activity: Ahead of Q4 results, Swiggy’s stock saw moderate sell-offs, indicating cautious investor sentiment.

- Market reaction: Post-results, the stock remained under pressure, reflecting concerns around mounting losses despite topline strength.

- Long-term outlook: For long-term investors, Swiggy remains a high-risk, high-reward play. While revenue growth is strong, the company’s ability to curb quick commerce losses will be a key determinant of future stock performance.

💡 Investor Note: Given its aggressive expansion, Swiggy may take several more quarters to achieve consolidated profitability. However, its leadership in food delivery and rapid growth in Instamart could drive significant upside if operating leverage kicks in during FY26.

Final Take: Cautious Optimism for the Long Haul

Swiggy’s Q4 FY25 results reaffirm its position as a fast-scaling tech platform with a diversified portfolio. But the road to profitability is far from smooth. Investors must stay alert to quarterly burn rates and competitive developments.

If you’re tracking new-age tech IPOs, Swiggy offers a window into the evolving business models of India’s digital economy. But like many digital-first companies, the balance between scale and sustainability will determine Swiggy’s fate on the Street.