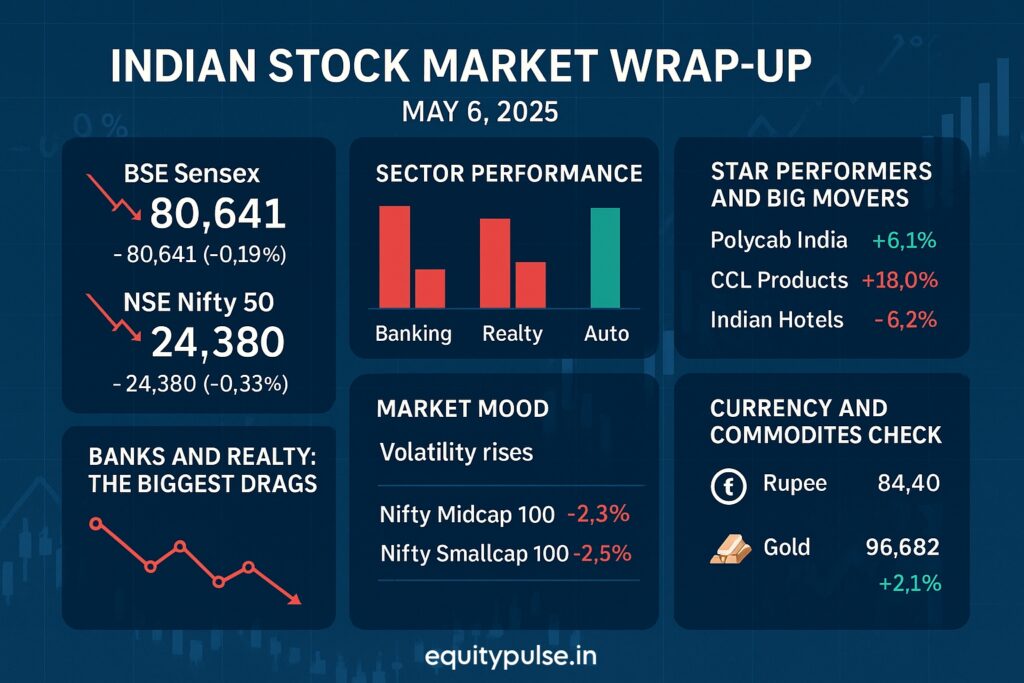

The Indian stock market took a breather on Tuesday, May 6, 2025, after a solid winning streak. With investors turning cautious and booking profits, both key benchmarks ended in the red. The BSE Sensex slipped 156 points to 80,641, while the NSE Nifty 50 lost 81.5 points, closing at 24,380.

Banks and Realty: The Biggest Drags of the Day

It was a rough session for PSU banks and real estate stocks, which took the biggest hit. The Nifty PSU Bank index tanked almost 5%, with Bank of Baroda crashing 10.9%, followed by steep losses in Union Bank (-6.3%) and Bank of India (-6.2%).

Why the panic? Investors are nervous ahead of quarterly earnings, especially about asset quality and loan growth. Realty stocks didn’t fare any better, with Nifty Realty down 3.6%, led by names like Godrej Properties (-6.4%) and Sobha (-5%). Higher input costs and interest rates continue to weigh on the sector.

Auto Stocks Keep It Rolling

While most sectors were down, auto stocks held their ground. Thanks to strong April sales and optimism around Q4 results, this space showed some resilience. Mahindra & Mahindra was among the top gainers, while Tata Motors stayed relatively steady. The sector’s performance helped limit the damage across the board.

Star Performers and Big Movers

Some stocks stood out despite the broader sell-off:

- Polycab India jumped over 6% after posting strong Q4 numbers. Investors loved the growth story in wires and cables.

- CCL Products shot up a massive 18%—its biggest single-day gain in 4 years—thanks to strong quarterly profits in its coffee business.

- On the flip side, Indian Hotels fell more than 6% as traders booked profits after earnings.

- Stocks like Adani Ports, SBI, Tata Motors, and Eternal (formerly Zomato) slipped between 2–3%.

Market Mood: Nervousness Creeps In

Market sentiment was shaky. Around 20 out of 30 Sensex stocks ended in the red. The India VIX, which measures volatility (aka how jittery the market is), rose 3.6% to 19, showing investors are getting a bit anxious ahead of earnings and global events.

Midcaps and Smallcaps Struggle Too

The weakness wasn’t just in the big names. Midcap and smallcap stocks also took a beating, with the Nifty Midcap 100 down 2.3% and the Smallcap 100 falling 2.5%. Risk appetite definitely took a backseat today.

Currency and Commodities Check

The rupee edged lower, trading near ₹84.40 against the US dollar, mainly due to global dollar strength.

Gold shone bright, gaining over 2% to hit around ₹96,682 per 10 grams. Looks like investors are turning to safe havens again.

What’s Spooking the Markets Globally?

Weak factory data from China and worries over the US Fed’s next move on interest rates put pressure on global markets. Asian indices were mostly down, and that nervousness spilled over into Indian equities too.

Earnings Season: Eyes on Banks and Tech

The Q4 earnings season is heating up. This week, markets will watch results from banks and IT companies closely. PSU bank results are especially crucial right now, given today’s sharp sell-off. Investors want clarity on loan growth, bad loans, and credit demand as we head into FY26.

What’s Next? Key Things to Watch

- Here’s what investors should keep an eye on this week:

- India’s inflation (CPI) and industrial production (IIP) data

- Crude oil prices, which affect inflation and import bills

- Any policy developments around banking and real estate

- More Q4 earnings, especially from large-cap names

The Bottom Line

Tuesday’s session was a reality check for the bulls. PSU banks and realty stocks dragged the market down, while autos offered some support. With volatility on the rise and earnings season in full swing, the next few sessions could be bumpy. It’s a good time for investors—especially beginners—to stay diversified and not chase momentum blindly.